Employment Blog December 2021

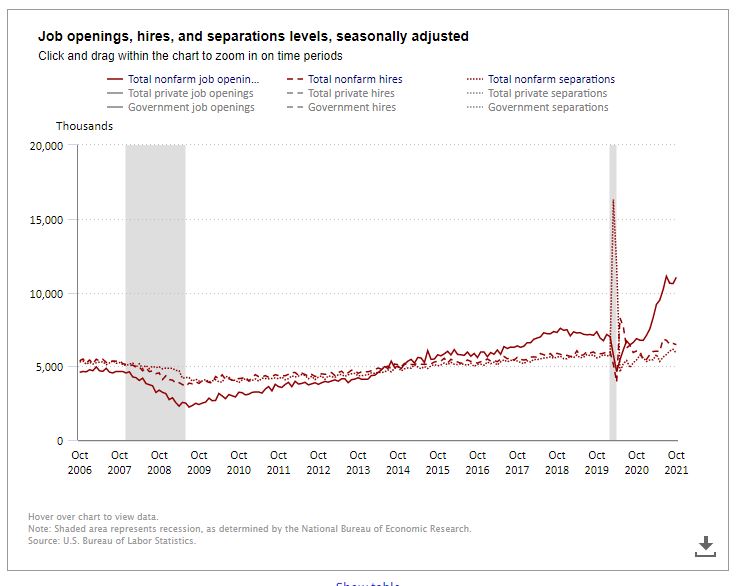

This Employment Blog is taken from the Bureau of Labor Statistics, U S Department of Labor. Nonfarm payroll employment rose by 210,000 in November, and the unemployment rate fell by 0.4 percentage point to 4.2 percent. Notable job gains occurred in professional and business services, transportation and warehousing, construction, and manufacturing. Employment in retail trade declined over the month. Thus far this year, monthly job growth has averaged 555,000. Employment has increased by 18.5 million since April 2020 but is down by 3.9 million, or 2.6 percent, from its level before the onset of the coronavirus (COVID-19) pandemic in February 2020. Total job openings were at an all time high as presented below.

Employment in professional and business services increased by 90,000 in November. Within the industry, employment in the professional and technical services component rose by 44,000 over the month and is 367,000 higher than in February 2020. (Professional and technical services includes industries such as management and technical consulting services, scientific research and development services, and computer systems design and related services.) Employment in the administrative and waste services component (which includes temporary help services) rose by 42,000 over the month but is 359,000 lower than in February 2020. Employment in professional and business services overall is down by 69,000 since February 2020.

Transportation and warehousing added 50,000 jobs in November. Employment in the industry is 210,000 above its February 2020 level. In November, employment growth was led by couriers and messengers (+27,000) and warehousing and storage (+9,000).

In November, job growth continued in construction (+31,000). Employment continued to trend up in specialty trade contractors (+13,000), construction of buildings (+10,000), and heavy and civil engineering construction (+8,000). Construction employment is down by 115,000 since February 2020.

Manufacturing continued to add jobs in November (+31,000). Within the durable goods component, miscellaneous durable goods manufacturing (+10,000), fabricated metal products (+8,000), and electrical equipment and appliances (+3,000) gained jobs. Employment declined in motor vehicles and parts (-10,000). Machinery lost 6,000 jobs, largely reflecting a strike in the industry. In the nondurable goods component, employment increased by 16,000. Overall, manufacturing employment is 253,000 lower than in February 2020.

Employment in financial activities continued to trend up in November (+13,000) and is 30,000 higher than in February 2020. Over the month, job growth occurred in securities, commodity contracts, and investments (+9,000).

Employment in retail trade declined in November (-20,000). Job losses occurred in general merchandise stores (-20,000); clothing and accessory stores (-18,000); and sporting goods, hobby, book, and music stores (-9,000). These losses more than offset gains in food and beverage stores (+9,000) and in building material and garden supply stores (+7,000). Retail trade employment is 176,000 lower than in February 2020.

In November, employment in leisure and hospitality changed little (+23,000), following monthly job gains averaging 271,000 in the previous 9 months. Employment in the industry is 1.3 million, or 7.9 percent, lower than in February 2020.

Health care employment was about unchanged in November (+2,000). Within the industry, employment in ambulatory health care services continued to trend up (+17,000), while nursing and residential care facilities lost 11,000 jobs. Employment in health care is 450,000 below its February 2020 level, with nursing and residential care facilities accounting for nearly all of this loss.

Employment also showed little change over the month in other major industries–including mining, wholesale trade, information, other services, and public and private education.

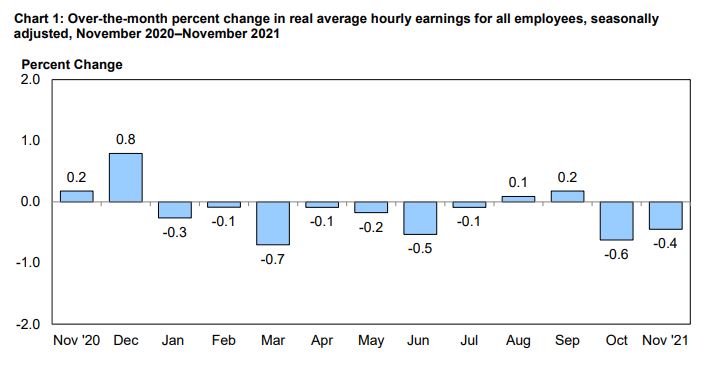

Real average hourly earnings for all employees decreased 0.4 percent from October to November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.3 percent in average hourly earnings combined with an increase of 0.8 percent in the Consumer Price Index for All Urban Consumers (CPI-U). Real average weekly earnings decreased 0.2 percent over the month due to the change in real average hourly earnings combined with an increase of 0.3 percent in the average workweek.