Employment Blog July 2020

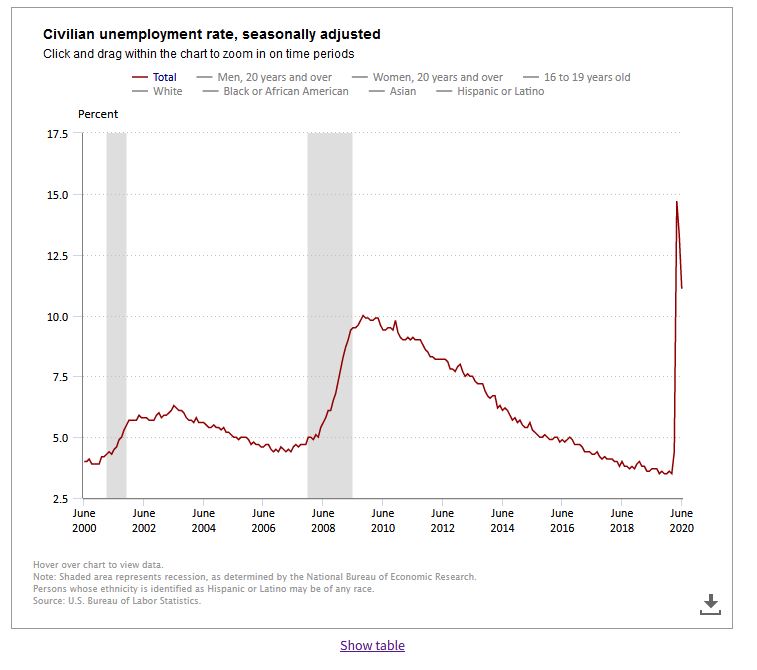

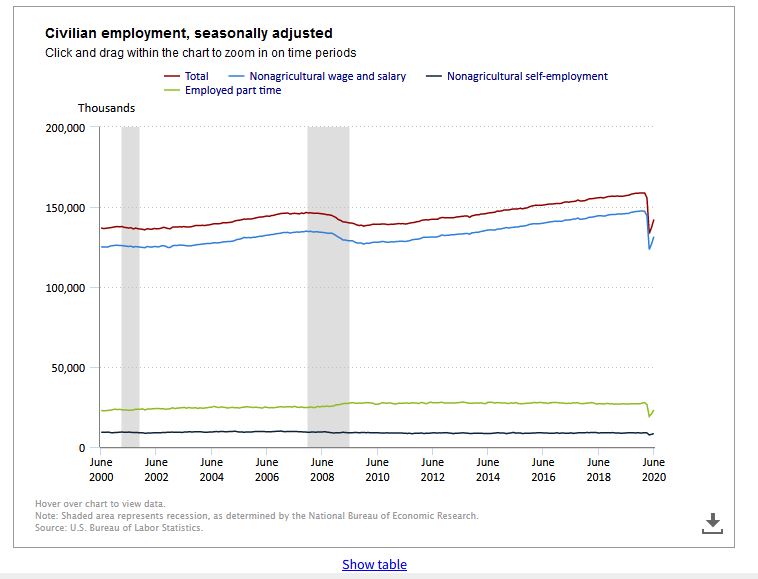

This Employment Blog is taken from the US Department of Labor, Bureau of Labor Statistics. Nonfarm payroll employment increased by 4.8 million in June, and the unemployment rate declined by 2.2 percentage points to 11.1 percent. These improvements reflect the continued resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it. In June, employment continued to rise in several major industry sectors, with the largest gain in leisure and hospitality. Notable gains also occurred in retail trade, education and health services, other services, manufacturing, and professional and business services. To put the June employment gain of 4.8 million in context, substantial job losses related to the coronavirus pandemic started in March, as employment fell by 1.4 million. This was followed by deeper job cuts in April, when payroll employment declined by 20.8 million, as revised. By May, some pandemic related restrictions on economic activity began to be lifted, and employment rose by 2.7 million, as revised. This rebound in business activity accelerated in June. Nevertheless, total nonfarm employment is 14.7 million, or 9.6 percent, lower than in February. Furthermore, although unemployment continued to fall in June, the unemployment rate and the number of unemployed people are up by 7.6 percentage points and 12.0 million, respectively, since February.

Taking a closer look at the June payroll data, employment in leisure and hospitality increased by 2.1 million, accounting for about two-fifths of growth in total nonfarm employment. Within the industry, employment in food services and drinking places rose by 1.5 million. This followed an increase of the same magnitude in May. Despite the gains in May and June, employment in food services and drinking places remains 3 million lower than in February. Employment in amusements, gambling, and recreation increased by 353,000 in June, and the accommodation industry added 239,000 jobs.

Retail trade employment increased by 740,000 in June but is 1.3 million lower than in February. Job growth occurred among all component industries in June. Notable job gains occurred in clothing and accessories stores (+202,000), general merchandise stores (+108,000), motor vehicle and parts dealers (+84,000), furniture and home furnishings stores (+84,000), and miscellaneous store retailers (+70,000).

In June, employment in education and health services increased by 568,000 but is down by 1.8 million from February. In June, health care employment rose by 358,000, with gains in offices of dentists (+190,000), offices of physicians (+80,000), offices of other health practitioners (+48,000), and outpatient care centers (+24,000). Elsewhere in health care, job losses continued in nursing care facilities (-18,000). Employment in social assistance increased by 117,000, with gains in child day care services (+80,000), individual and family services (+28,000), and vocational rehabilitation services (+9,000). Employment in private education rose by 93,000. Employment in the other services industry rose by 357,000 in June, with about three-fourths of the gain occurring in personal and laundry services (+264,000). Since February, employment in the other services industry is down by 752,000.

Manufacturing employment increased by 356,000 in June, after an increase of 250,000 in May. Over the past 2 months, the industry has recovered less than half of the 1.4 million jobs lost in March and April. Most of the recent changes in manufacturing employment have occurred in durable goods manufacturing; in June, employment increased in motor vehicles and parts (+196,000), miscellaneous durable goods manufacturing (+26,000), and machinery (+18,000). Job gains in the nondurable goods component occurred in plastics and rubber products (+22,000), miscellaneous nondurable goods manufacturing (+16,000), and apparel (+9,000).

In June, professional and business services added 306,000 jobs. On net, employment in the industry is 1.8 million below its February level. In June, employment gains occurred in temporary help services (+149,000), services to buildings and dwellings (+53,000), and accounting and bookkeeping services (+18,000). Job losses occurred in computer systems design and related services (-20,000) and in travel arrangement and reservation services (-8,000).

Construction employment rose by 158,000 in June, after increasing by 453,000 in the prior month. Over the past 2 months, construction has recovered more than half of the cumulative job losses from March and April. In June, the majority of the job growth occurred in specialty trade contractors (+135,000), with gains about equally split between the nonresidential (+71,000) and residential (+64,000) components. Construction of buildings added 32,000 jobs over the month, while heavy and civil engineering construction lost jobs (-10,000).

Employment in transportation and warehousing increased by 99,000 in June, following losses of 28,000 in May and 560,000 in April. Over the month, notable job gains occurred in warehousing and storage (+61,000) and couriers and messengers (+21,000).

In June, wholesale trade employment rose by 68,000, with increases in the durable goods (+39,000) and nondurable goods (+27,000) components. Employment in wholesale trade is 317,000 lower than its February level.

Employment in financial activities rose by 32,000 in June, with real estate adding 18,000 jobs. Since February, employment in financial activities is down by 237,000.

Government employment was little changed in June (+33,000), following declines of 533,000 in May and 952,000 in April. In June, an employment gain in local government education (+70,000) was partially offset by losses in state government (-25,000).

Employment in mining fell by 10,000 in June, mostly in support activities for mining (-7,000). The mining industry has lost 123,000 jobs since a recent peak in January 2019, although most of this decline has occurred since February 2020.

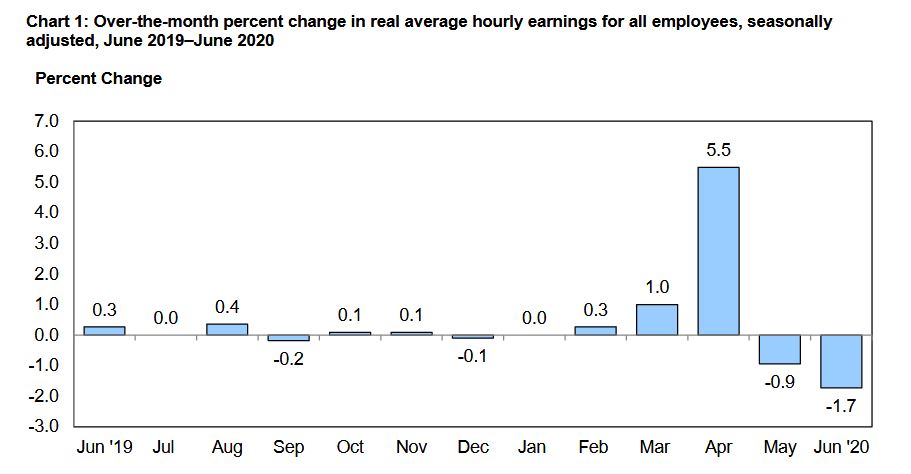

Real average weekly earnings decreased 2.3 percent over the month due to the change in real average hourly earnings combined with a 0.6-percent decrease in the average workweek.